Little Known Facts About zero down bankruptcy virginia.

Exemptions: Determined by your state’s laws along with the federal exemption scheme, you could be capable to exempt part or all your tax refund. Exemptions can protect particular belongings from currently being taken by the bankruptcy trustee. When your tax refund is entirely exempt, it is possible to continue to keep it.

Somebody on our group will link you having a money Expert within our network Keeping the right designation and abilities.

Finally, frequently reviewing the status of your respective bankruptcy estate can assist make sure you're properly reporting money and belongings into the bankruptcy courtroom and the IRS, assisting stay clear of potential problems.

Nonetheless, tax refund volume portions that are derived from the money you acquired just after filing are exempt from staying seized by your trustee, as is any tax refund you get for the following 12 months.

Does one very own a small organization? Discover how bankruptcy can assist with your business’s debts and money problems.

You don't choose to try to deplete your refund with no guidance of the attorney as this could lead to repercussions within your situation. (Read through this prior website about factors you shouldn't do before filing bankruptcy.)

Our Internet site undergoes normal updates and servicing, which implies there may be times when we cannot ensure that all information and facts is totally accurate and latest. We're dedicated to constantly including new agencies and attorneys to our listings and updating our written content with the newest read the article data because it gets available.

In this particular weblog, we will try this site delve in to the specifics of tax refunds in a Florida bankruptcy and provide clarity on what folks can be expecting.

As an example, a refund due for your calendar year before you decide to file for bankruptcy is typically regarded Portion of the estate. Nonetheless, proactive measures can often protect a portion or all of find more your refund, according to the exemptions out there inside your condition.

For those who require lawful guidance but simply cannot afford to pay for an attorney, trying to find pro bono lawyers and obtaining authorized assistance for free could be a great solution. But what on earth is pro bono on the planet? Read on to figure out.

Various unfavorable components make this a risky debt-aid choice, but if it retains you from being forced to file bankruptcy, it’s almost certainly worth it.

Offered the complexity of bankruptcy and tax laws, consulting by official source using a bankruptcy attorney or tax professional is often highly recommended. These experts can provide assistance tailor-made towards your situation and enable you to navigate the intricacies of bankruptcy and tax obligations.

Our workforce of reviewers are established experts with many years of experience in areas of personal finance and maintain numerous Highly developed levels and certifications.

When it comes to retaining the utmost amount of The cash your government offers you back for navigate to these guys spending your taxes following a chapter seven bankruptcy filing, it really all will come down to timing!

Neve Campbell Then & Now!

Neve Campbell Then & Now! Barret Oliver Then & Now!

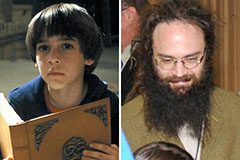

Barret Oliver Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!